Discord in the OPEC+ Oil Patch

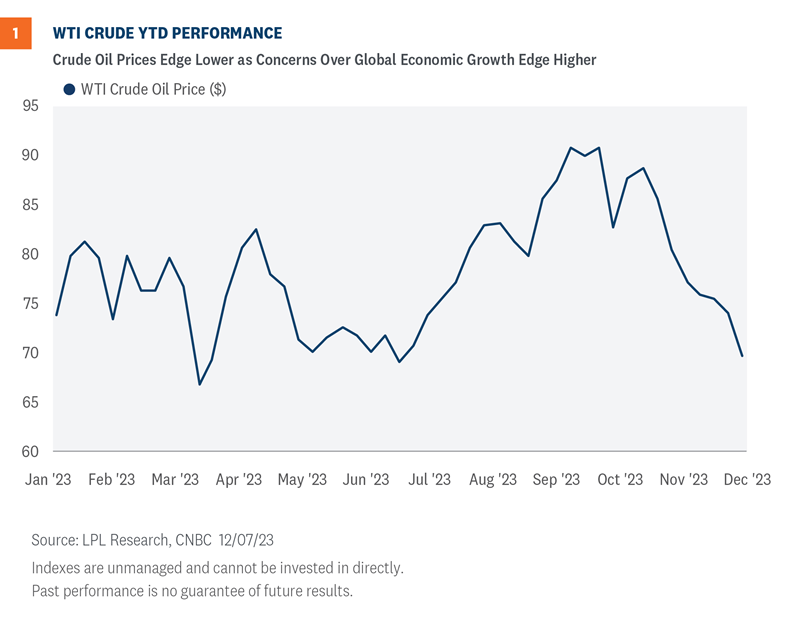

Despite a heavy lobbying effort to cajole OPEC+ members to agree to a unified cut in oil production, Saudi Arabia, the de facto leader of the energy cartel, was unable to orchestrate anything more than pledges on a “voluntary” basis. Accordingly, benchmark oil prices continued to slide lower following the announcement, and without a catalyst to propel prices higher, oversupply in the market coupled with concerns over the global economic landscape, have steadfastly kept prices lower.

Nonetheless, forward pricing forecasts indicate prices will climb higher. The role of the Saudis as the OPEC+ leader has been questioned regarding how ineffective they’ve been in organizing a viable response to softening prices. The broader issue for the cartel is whether the current structure is flexible enough to accommodate the disparate economic needs of its constituents, especially in a challenging economic environment.

The Saudi Challenge

Leading up to what was considered an important ministerial OPEC+ meeting scheduled for the end of November, there was considerable pushback against Saudi attempts to engineer a coordinated response to the slide in crude oil prices, leading the cartel to postpone the meeting with hopes of organizing a solid and unified response to falling prices.

Although the newly organized online gathering offered a significant cut in production, much of it was based on voluntary pledges, and it did little to impress crude oil benchmark pricing.

Moreover, it indicated the inability of Saudi leadership to forge a viable consensus as African member nations, in particular, were reluctant to cut production.

Another Attempt to Unify OPEC+

With Vladimir Putin’s visit to the Middle East completed, and following his OPEC+-related discussions with Saudi Crown Prince Mohammed bin Salman, Russia and Saudi Arabia, the two largest global exporters of oil, and both seemingly determined to put a floor under sagging prices, issued a joint statement urging all members of the energy consortium to cooperate with the need to reduce production “in a way that serves the interests of producers and consumers and supports the growth of the global economy.”

Over Supply Thwarting Higher Prices

Consistent reports of oil oversupply have hindered the market’s attempt to drive prices higher.

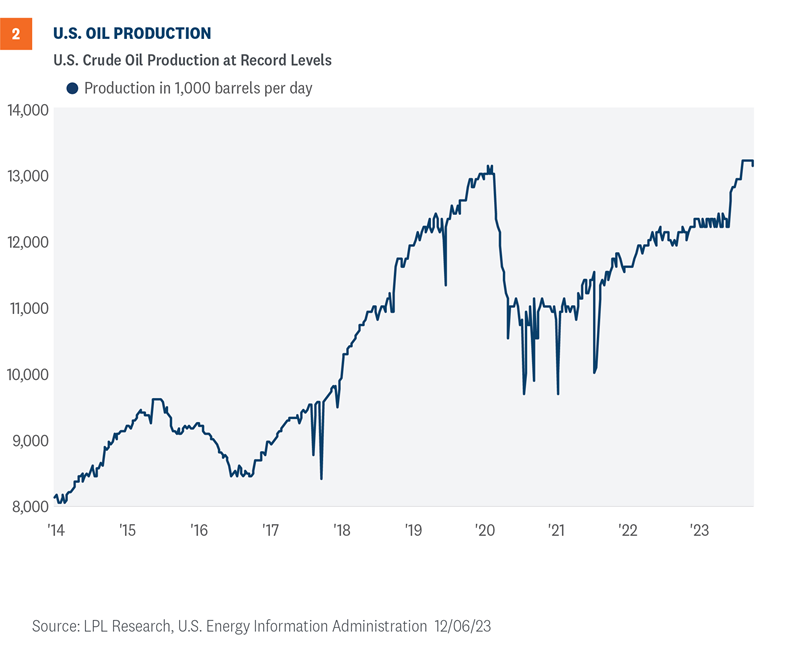

Production in the U.S. has reached record levels with 13.24 million barrels a day being added to supplies, which is more than supply from Russia or Saudi Arabia. Forecasts call for 2024 production to increase by an additional 500,000 barrels of oil a day.

Gasoline prices in the U.S. have fallen comfortably and have helped elevate consumer sentiment.

Iran has also been pumping more oil, although there are questions regarding the exact amount. Most analysts agree, however, that Iran currently has 26 million barrels of oil on floating storage facilities, which are designated for global sales.

Prices have received some support recently as the Biden Administration seeks to begin replenishing the Strategic Petroleum Reserve (SPR); however, the global oversupply of stockpiles counters the slow process of adding to the SPR.

A Softer Global Backdrop—China Continues to Disappoint

As China’s economic recovery continues to disappoint, markets hope Beijing will introduce a broad fiscally-oriented program to bolster growth. Crude oil exports to China, the world’s largest importer of oil, have declined significantly as Beijing struggles to focus on the ongoing debt problems enveloping the once prominent property market.

Thus far, monetary measures have been introduced to help maintain liquidity in the failing sector. Consumer spending in China has suffered as the economy remains sluggish, and manufacturing has slowed.

The recent Politburo meeting offered a modicum of hope that Beijing is prepared to combine monetary policy with fiscal stimulus, although there has not yet been an announcement regarding numeric targets.

The important Third Plenum, during which medium-to-longer term economic and political plans are introduced, has apparently been postponed until 2024, even though it was expected this year. If the Plenum agenda includes a forceful program for fiscal spending it is expected to be a primary catalyst for oil as well as the broader industrial metals complex.

Economic Cross Currents in the U.S.

With a steady stream of economic data suggesting an imminent economic slowdown, recent data defies predictions. Payroll data surprised to the upside, and consumer confidence is also indicating a pickup in sentiment, all of which typically should help oil prices inch higher.

OPEC+ Options

The Saudis are still determined to negotiate an agreement so they can push prices into the $85–90 range. The Saudi budget demands higher prices as off-budget projects, in addition to an expensive welfare budget, were based on higher oil prices.

With lower income from crude oil products, the government has accepted there will be fiscal deficits as spending continues amid weaker prices, but even with low debt levels the need for higher prices remains acute.

Unless global growth ramps up markedly—and with global central banks at the end of their respective rate hiking cycles this is a possibility at the margin—the constant drumbeat of “recession” headlines may continue to hinder the ability for prices to extend gains.

The Saudis and Russia, their OPEC+ partner, appear determined to keep trying to forge a solid bloc to cut production dramatically enough to reach a higher price point but not so high as to ignite a global recession.

There's been chatter among energy analysts and oil traders that the Saudis could be inclined to repeat a desperate maneuver from November 2014 when OPEC decided to flood the market with oil to bring down prices dramatically to force higher cost producers—read U.S. shale producers—out of the market. Damage ensued across the industry, and it isn't likely they'll again resort to such measures.

It’s a delicate balance to be sure, but by all accounts, the Saudis continue to lobby member nations apparently with side deals for them to accept the cuts. A win on a unified announcement could help restore confidence in Saudi leadership within the cartel and, along with increasingly favorable seasonals, promote stability in oil prices.

Investment Conclusion

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) recommends a neutral tactical allocation to equities, with a modest overweight to fixed income funded from cash. The risk-reward trade-off between stocks and bonds looks relatively balanced to us, with core bonds providing a yield advantage over cash.

The Committee favors the energy sector based on its expectations for higher oil prices, discipline from producers, and increasing returns of capital to shareholders.

The STAAC recently upgraded its view on the communication services equity sector, moving to overweight based on supportive valuations, strong earnings growth, and favorable technical analysis trends. In conjunction with that move, the STAAC also downgraded the industrials equity sector to neutral based on slowing capital investment activity and a technical backdrop no longer commensurate with an overweight view.

The STAAC recommends large cap growth style equities over their large cap value counterparts. The STAAC believes that growth style large-cap equities may benefit from lower inflation and stabilization of interest rates in the intermediate term. Growth stocks may also benefit from superior earnings prospects against a backdrop of a slowing economy.

Within fixed income, the STAAC recommends an up-in-quality approach with benchmark-level interest rate sensitivity. We think core bond sectors (U.S. Treasuries, agency mortgage-backed securities (MBS), and short-to-intermediate maturity investment grade corporates) are currently more attractive than plus sectors (high-yield bonds and non-U.S. sectors) with the exception of preferred securities, which look attractive after having sold off this spring due to stresses in the banking system.

Quincy Krosby, PhD, Chief Global Strategist

Joshua Cline, Analyst

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

For a list of descriptions of the indexes and economic terms referenced in this publication, please visit our website at lplresearch.com/definitions.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered inv estment advisor and broker -dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment a dvice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

| Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value |

RES-000347-1123 | For Public Use | Tracking #514993 (Exp. 12/2024)